Navigating the De-Fi space can involve risk. Never give up the private key to your wallet, avoid clicking risky links, engaging with scam NFT’s and be sure to do your own research to ensure it’s right for your circumstances before participating. De-Fi has great potential but like any other part of the finance world, bad actors do exist.

If you’ve been in the crypto space a while, you’re probably well and truly used to the epic highs and lows that often come when navigating the space. With everything from exchanges going under, to smart contract hacks right through to the unexpected airdrops the crypto ride can be a wild one.

However, the space also cops a bad rap sometimes with bad actors, hacks and lack of usability being common complaints heard by newbies. The fact is though, that blockchain tech has vast potential and that’s the type of stuff we need to impart on newcomers to the space. Today, we’ll try to impart some of the benefits that come with the technology, by taking a deep dive into Decentralized Finance, also known as De-Fi. With the potential to upset the big banks, De-Fi promises to put finance power back in the hands of users. Let's check it out!

What is De-Fi

DeFi, or Decentralized Finance, refers to a set of financial services and applications built on blockchain technology, primarily on platforms like Ethereum or even better, Solana. Unlike traditional finance, DeFi operates without traditional intermediaries like banks or brokerages. Instead, it leverages smart contracts (self-executing code on the blockchain) to facilitate and automate financial transactions.

Key elements of DeFi include lending, borrowing, trading, and yield farming. Users can lend their cryptocurrencies to others and earn interest, borrow assets by providing collateral, trade various digital assets directly on decentralized exchanges, and participate in liquidity provision to earn rewards.

DeFi’s decentralized nature is driven by the principles of openness, transparency, and accessibility, aiming to provide financial services to anyone with an internet connection, while reducing reliance on centralized institutions. However, users should be aware that there are risks associated with smart contract vulnerabilities and market fluctuations in the relatively immature DeFi space.

So in essence De-Fi allows us to earn yield, access cryptocurrencies and use automation behind the scenes to leverage investment and borrowing services. Nice!

Why Solana?

When you think of cryptocurrencies it’s pretty reasonable to say that the Big 2 are usually the first to come to mind. Bitcoin (BTC) & Ethereum (ETH). However, despite ETH holding on to that number two position, there are some limitations that come with it. Namely, gas fees. De-Fi requires speed and efficiency, and while ETH can provide the speed, that efficiency (gas) remains an ongoing problem. Not many people want to access De-Fi if gas fees on transactions are ridiculous and because of this the concept of De-Fi relies on low-cost gas as much as it does blockchain throughput.

Because of this, SOL is perfectly placed to leverage the benefits of increasing activity within the ecosystem and introduce De-Fi to the masses quickly, easily and more importantly, cheaply.

If you’re a newbie to the crypto space, we’ll throw out a quick explanation of why gas is important when you’re dealing with something like this.

In the context of blockchains, particularly on networks like Ethereum, “gas” refers to the unit that measures the amount of computational effort required to execute operations or transactions. Gas is a crucial concept for understanding the cost and resource allocation on blockchain networks.

Here’s a breakdown of the concept of gas and how it works for our purposes:

Computational Cost: Each operation or transaction on the blockchain network requires computational resources to be executed. These operations might include sending a transaction, executing a smart contract, or interacting with decentralized applications (dApps).

Gas Units: Gas is used to quantify the amount of computational work required for a specific operation. Transactions and smart contracts are priced in terms of gas units. The more complex or resource-intensive the operation, the more gas it will consume.

Gas Price: Gas price represents the cost per unit of gas in terms of the cryptocurrency native to the blockchain network (e.g., Ether on Ethereum). Users set the gas price when submitting transactions, determining how quickly the transaction will be processed. A higher gas price incentivizes miners or validators to prioritize the transaction.

Transaction Cost: The total cost of a transaction is calculated by multiplying the gas consumed by the gas price. It reflects the fee paid to miners or validators for processing the transaction and securing the network.

Efficiency and Optimization: Developers and users aim to write efficient smart contracts and execute operations with minimal gas consumption. This helps in reducing transaction costs and ensures optimal use of blockchain resources.

Gas Limit: Each block on the blockchain has a gas limit, which represents the maximum amount of computational work that can be included in that block. Users need to set a gas limit when submitting transactions. If the gas limit is too low, the transaction may run out of gas before completion.

Historically, Ethereum has had issues keeping gas prices manageable and although L2 solutions for mitigating this do exist, some of the other players like Solana are competitors for building within this space. With gas fees just a fraction of a cent on Solana, the ability to leverage this for De-Fi infrastructure is real and that potential is part of the reason for the latest Solana hype we’ve been seeing within the ecosystem. With airdrops, NFT capability and LOTS of good exchanges it’s an exciting time to be a part of the Solana journey.

What Can We Do??

So, we understand the concept of De-Fi, as well as how the concept of gas and speed underpins it. The next logical question is what can we do with it. And that is a brilliant question. While the space continues to evolve with new products and services we can look at a few of the existing bigger features we can leverage as crypto holders in the De-Fi space.

Borrowing and Lending: DeFi lending, short for Decentralized Finance lending, operates on blockchain platforms, allowing users to lend and borrow digital assets through smart contracts. These contracts define terms such as interest rates, loan durations, and collateral requirements without relying on traditional financial intermediaries. Lenders earn interest on their deposited assets, while borrowers can access funds by providing collateral. This decentralized system promotes financial inclusion and eliminates the need for trust in centralized institutions. Participants engage in lending protocols to either earn passive income or secure liquidity for various purposes.

Liquidity Pools: A liquidity pool is a fundamental concept in decentralized finance (DeFi), where users contribute their cryptocurrency assets to a smart contract, forming a pool of liquidity. These pools serve as the backbone for decentralized exchanges and lending platforms, allowing users to trade or borrow directly from the pool. In exchange for providing liquidity, participants earn a share of the transaction fees generated by the platform. The automated and algorithmic nature of liquidity pools eliminates the need for traditional market makers, fostering a decentralized and more efficient trading environment. Users contribute to these pools by depositing pairs of assets, often in equal value, to maintain balanced liquidity. While participating in liquidity pools can be a lucrative way to earn passive income, it comes with certain risks.

Yield Farming: Yield farming is a DeFi strategy that involves users providing liquidity to decentralized finance protocols in exchange for earning rewards, typically in the form of additional tokens or a share of transaction fees. Participants contribute their funds to liquidity pools or lending platforms, allowing these protocols to operate smoothly. In return, they receive native tokens or other incentives. Yield farming often requires users to stake or lock up their assets, and the rewards are proportionate to the amount of liquidity provided. This strategy has gained popularity due to its potential for high returns, but it also comes with risks, including smart contract vulnerabilities, market fluctuations, and the concept of impermanent loss. Yield farmers navigate different DeFi platforms to optimize their returns, making it a dynamic and constantly evolving aspect of the decentralized finance ecosystem.

Trading: Trading involves the buying and selling of digital assets on decentralized exchanges (DEXs) or other DeFi platforms without the need for intermediaries. Participants can engage in various trading strategies, such as spot trading, margin trading, and decentralized derivatives trading, using smart contracts to execute transactions. Unlike traditional financial markets, DeFi trading operates 24/7 and is accessible to anyone with an internet connection and a compatible wallet. Decentralized exchanges leverage liquidity pools created by users, and trading is often facilitated by automated market-making algorithms. Traders in the DeFi space enjoy greater control over their assets, lower fees compared to traditional exchanges, and the ability to trade a wide range of tokens.

Stablecoins

If you’re reasonably new to the space, if you’ve heard anything about crypto one of those things was probably that the price was volatile and the market could often be risky. And in a lot of cases, this can be true. If you’re a memecoin trader that might not be a bad thing, but if you’re looking to leverage De-Fi for transactional purposes then you might find that stablecoins are more suitable for your purposes.

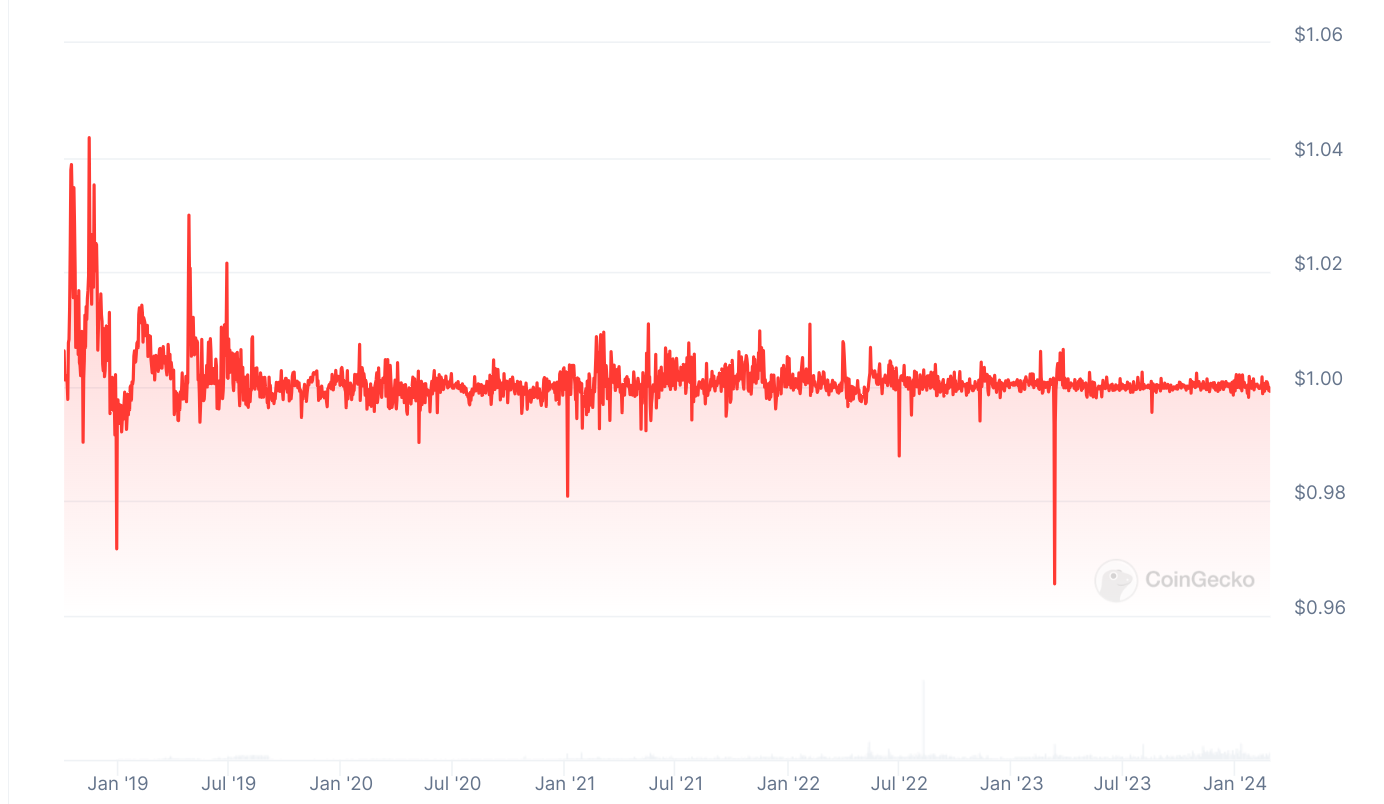

Saying it all with the name, stablecoins aim to provide a “stable” currency that isn't susceptible to the same style of fluctuations we’ll often see other tokens exhibit. While they aren’t everyone's cup of tea, they provide a means of providing stable exchange rates which gives some risk mitigation when you’re carrying out De-Fi transactions.

Aiming to be pegged at around 1 USD per token, stablecoins give the ability to transact without running the risk of having market fluctuations rain on your parade. They also provide transfer services and can be a good way to interact with crypto “bridges” that allow you to use your crypto on different blockchains.

Why Would We Use It?

Despite crypto having some element of risk, if you decide to go on a De-Fi journey and take some smart steps chances are you’ll probably have a decent time. While many benefits justify being able to make the leap and give it a shot probably one of the biggest things that incentivise that is token airdrops. Given to users who have engaged with De-Fi services and different protocols these airdrops can range from a few dollars worth to tens of thousands of dollars in some instances.

For instance, to promote the new Solana Saga, purchasers would receive the Saga Genesis NFT. Holders of this NFT were later given numerous airdrops as a thank-you for holding the NFT, supporting the Saga project and engaging within the Solana ecosystem. These airdrops were far larger than the purchase price of the Saga and pushed the price of the phone far beyond its initial launch price and was partly responsible for the increase in activity we’ve seen over the past few months.

However, you’ll also find the ability to engage with new technology throughout your journey. While you won’t need to be a tech nerd to grasp everything, you will need to understand how to use a crypto wallet, and what some of the pitfalls and risks are behind using such projects. You’ll also learn how to use Liquidity Pools, how to use and revoke wallet authorisations and how to transact on the blockchain effectively. While beginners may need some time to get their head around this you’ll find plenty of learning resources to assist in making the transition a bit smoother, including some that we’ve released ourselves.

Remember three steps before you start though

Use a separate wallet for transacting through De-Fi. If your wallet is breached your risk position is then minimal.

Checking what services you sign your wallet is an essential security step.

Backing up your wallet's seed phrase is critical, as there is little in the way of help should you lose access to your wallet.

Where Do I Start

Being huge fans of Solana it's only natural we’d send you there to start your journey. Because as you now know it’s low gas, fast and has quite the assortment of De-Fi products already available. So let's share a few of our favourites.

Get started by using the Jupiter Exchange

Check out MarginFi

Check out Kamino Finance

Check out Drift Finance

And if you’re interested in learning more about Web3 activities on Solana, you can read our walkthrough article that focuses on the Creator Economy via this link.

Medium has recently made some algorithm changes to improve the discoverability of articles like this one. These changes are designed to ensure that high-quality content reaches a wider audience, and your engagement plays a crucial role in making that happen.

If you found this article insightful, informative, or entertaining, we kindly encourage you to show your support. Clapping for this article not only lets the author know that their work is appreciated but also helps boost its visibility to others who might benefit from it.

🌟 Enjoyed this article? Support our work and join the community! 🌟

💙 Support me on Ko-fi: Investigator515

📢 Join our OSINT Telegram channel for exclusive updates or

📢 Follow our crypto Telegram for the latest giveaways

🐦 Follow us on Twitter and

🟦 We’re now on Bluesky!

🔗 Articles we think you’ll like:

Signals From Space: The International Space Station

Ukraine OSINT: Strava Strikes Again

✉️ Want more content like this? Sign up for email updates